Double Taxation Refers to Which of the Following Scenarios

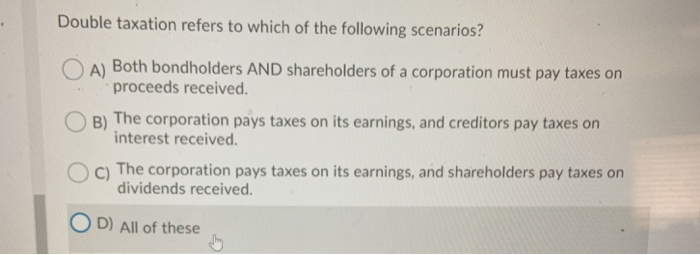

C The corporation pays taxes on its earnings and shareholders pay taxes on dividends. 9 Which of the following is not an advantage of a sole proprietorship.

Double Taxation Refers To Which Of The Following Scenarios A Both Bondholders Course Hero

11 Double taxation refers to which of the following scenarios.

. Double taxation is mainly found in two forms corporate double taxation which is taxation on corporate profits through corporate tax and dividend tax levied on dividend pay-outs and international double taxation which involves the taxation of foreign income in the country where the income is derived as well as the country where an investor is a resident. Double liability may be mitigated in a number of ways for example a jurisdiction may. Both bondholders and shareholders must pay taxes.

Double Taxation is an occurrence where the income from the same source is taxed twice before translating into net income. D The corporation pays taxes on revenues and expenses. The corporation pays taxes on earnings and creditors pay taxes on interest received.

B The corporation pays taxes on its earnings and creditors pay taxes on interest received. For instance profits earned by a company are taxed twice once when they are earned and then again the following year as dividends. In this scenario the business must pay corporate income taxes on profits.

Double taxation refers to the concept where the same income is taxed twice. If Game Guys Inc. Double taxation refers to which of the following scenarios.

Often times when people refer to double taxation in the United States they refer to certain kinds of income or activities that are either taxed twice or taxed directly. What is double taxation. The corporation pays taxes on its earnings and shareholders pay taxes on dividends.

A Both bondholders AND shareholders of a corporation must pay taxes on proceeds received. Distributes 20 of its net profit after taxes to its stockholders these funds will be taxed again when each individual stockholder claims hisher portion as earnings. The corporation pays taxes on revenues and expenses.

So for instance partners are taxed on the income they receive from a partnership but the partnership itself is not taxed because Congress intended to tax only the partners and not the. In other words when a company or individual is required to pay income taxes on the same income we refer to that as double taxation. Just as the term implies double taxation is when taxes are paid twice on the same income.

Instead of paying tax of 55 person A pays only 30 globally on the profit of 100. A Both bondholders and shareholders of a corporation must pay taxes on proceeds b The corporation pays taxes. Finance questions and answers.

It occurs when income is taxed at both the corporate and. Which of the following scenarios is an accurate example of double taxation. This is achieved mainly by the granting of double tax relief by the country of residence.

C The corporation pays taxes on its earnings and shareholders pay taxes on dividends received. OA Both bondholders AND shareholders of a corporation must pay taxes on proceeds received. For example c corporations will need to report their income at the end of their fiscal year and pay corporate income taxes on it.

The treaty must be ratified by both countries before it will enter into force. Double taxation refers to which of the following scenarios. Exempt foreign-source income from tax exempt foreign-source income from tax if tax had.

There are three scenarios where the law of double taxation applies. C corporation or C corp profits are taxed at both the shareholder and corporate levels. Double taxation refers to income taxes paid twice on the same income source.

A Both bondholders and shareholders must pay taxes. On 16 February 2022 Colombia and the Kingdom of the Netherlands signed a double tax treaty DTT. The traditional view in regard to the concept of double taxation is that to constitute double taxation objectionable or prohibited the two or more taxes must be 1 imposed on the same property 2 by the same state or government 3 during the same taxing period and 4 for the same purpose.

B The corporation pays taxes on its earnings and creditors pay taxes on interest received. A The owner receiving all the after-tax profit b Limited liability c Quick decision making d All of the above 10 Double taxation refers to which of the following scenarios. Double taxation is thus avoided.

In other words this is a tax policy where the government taxes income when the. Double taxation refers to which of the following scenarios. Asked Aug 18 2019 in Business by HalaMadrid.

Double taxation refers to which of the following scenarios. Double taxation refers to the income tax which is imposed twice on the same earned income asset or finance transaction by the same or multiple jurisdictions. It usually occurs when the same income is taxed both at corporate as well as at the individual level.

This corporate phenomenon occurs because company income is taxed at the corporate level and taxed again when distributed to shareholders through dividends. C The corporation pays taxes on its earnings and shareholders pay taxes on dividends received. The DTT aims to reduce taxation on transactions and investments between both countries without creating opportunities for non-taxation tax evasion or tax avoidance.

Double taxation is the levying of tax by two or more jurisdictions on the same income in the case of income taxes asset in the case of capital taxes or financial transaction in the case of sales taxes. OB The corporation pays taxes on its earnings and creditors pay taxes on interest received c The corporation pays taxes on its earnings and shareholders pay taxes on. B The corporation pays taxes on earnings and creditors pay taxes on interest received.

The over-riding objective of a DTA is the avoidance or minimisation of double taxation. In simple words when we pay income tax twice on the same source of earned income Earned Income Earned income is any. In regards to tax policy double taxation refers to taxing income more than once that was not intended by the tax authorities or it is the reason given for why the tax law works as it does.

A Both bondholders AND shareholders of a corporation must pay taxes on proceeds received.

Imputation Tax Meaning How It Works And More Tax Prep Tax Accounting And Finance

Reorganization 09 Powerpoint Templates Infographic Powerpoint Human Resource Management Templates

Solved Double Taxation Refers To Which Of The Following Chegg Com

No comments for "Double Taxation Refers to Which of the Following Scenarios"

Post a Comment